G. Halsey Wickser, Loan Agent for Dummies

Table of ContentsAbout G. Halsey Wickser, Loan AgentG. Halsey Wickser, Loan Agent - QuestionsThe smart Trick of G. Halsey Wickser, Loan Agent That Nobody is DiscussingNot known Details About G. Halsey Wickser, Loan Agent G. Halsey Wickser, Loan Agent Things To Know Before You Buy

When functioning with a mortgage broker, you must clarify what their charge framework is early on in the procedure so there are no surprises on shutting day. A mortgage broker generally just obtains paid when a financing closes and the funds are released.Most of brokers don't cost borrowers anything up front and they are normally risk-free. You need to make use of a mortgage broker if you desire to find accessibility to mortgage that aren't easily marketed to you. If you do not have incredible credit score, if you have an one-of-a-kind borrowing scenario like owning your own company, or if you simply aren't seeing mortgages that will function for you, after that a broker may be able to obtain you access to car loans that will certainly be helpful to you.

Home mortgage brokers might additionally have the ability to help lending candidates get a reduced interest rate than many of the industrial lendings offer. Do you need a home loan broker? Well, dealing with one can save a debtor effort and time throughout the application process, and possibly a great deal of cash over the life of the lending.

An Unbiased View of G. Halsey Wickser, Loan Agent

A professional home mortgage broker comes from, discusses, and refines residential and industrial mortgage in behalf of the customer. Below is a six factor guide to the solutions you must be supplied and the assumptions you need to have of a competent mortgage broker: A home loan broker supplies a variety of home mortgage loans from a number of various lenders.

A home mortgage broker represents your interests rather than the interests of a borrowing institution. They need to act not just as your representative, but as a knowledgeable specialist and problem solver - mortgage loan officer california. With accessibility to a large range of home mortgage items, a broker has the ability to use you the best value in terms of passion price, settlement amounts, and financing items

Numerous situations require greater than the simple use of a thirty years, 15 year, or adjustable price mortgage (ARM), so cutting-edge home loan approaches and advanced options are the advantage of dealing with a skilled mortgage broker. A mortgage broker navigates the client through any situation, handling the procedure and smoothing any kind of bumps in the roadway along the road.

G. Halsey Wickser, Loan Agent Can Be Fun For Everyone

Borrowers who locate they need bigger financings than their bank will accept additionally take advantage of a broker's knowledge and capacity to efficiently acquire funding. With a mortgage broker, you just need one application, as opposed to finishing forms for every specific lender. Your home loan broker can offer a formal contrast of any loans recommended, directing you to the info that properly portrays expense differences, with present prices, factors, and closing prices for each and every financing reflected.

A reliable home loan broker will certainly reveal just how they are spent for their solutions, as well as information the complete costs for the car loan. Individualized service is the setting apart aspect when selecting a mortgage broker. You need to anticipate your mortgage broker to aid smooth the method, be available to you, and advise you throughout the closing process.

The trip from dreaming about a new home to really having one may be loaded with obstacles for you, specifically when it (https://www.homemavenmember.com/united-states/glendale/local-businesses/g-halsey-wickser-loan-agent) concerns securing a mortgage in Dubai. If you have actually been presuming that going directly to your financial institution is the very best route, you may be losing out on an easier and possibly a lot more advantageous choice: collaborating with a mortgages broker.

Our G. Halsey Wickser, Loan Agent PDFs

One of the significant benefits of making use of a mortgage expert is the expert economic advice and crucial insurance coverage advice you get. Home mortgage experts have a deep understanding of the different monetary items and can help you pick the appropriate home loan insurance. They ensure that you are properly covered and offer recommendations tailored to your financial situation and long-lasting objectives.

A mortgage brokers take this problem off your shoulders by taking care of all the paperwork and application procedures. Time is money, and a home mortgage finance broker can save you both.

This implies you have a better chance of discovering a mortgage in the UAE that perfectly matches your needs, including specialized products that may not be offered with traditional banking channels. Navigating the home loan market can be complicated, especially with the myriad of products available. An offers expert guidance, helping you understand the pros and cons of each option.

See This Report on G. Halsey Wickser, Loan Agent

This expert suggestions is indispensable in safeguarding a mortgage that lines up with your financial goals. Mortgage consultants have actually established connections with many lenders, providing them substantial working out power.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Molly Ringwald Then & Now!

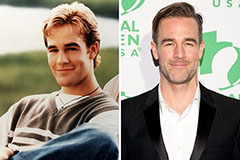

Molly Ringwald Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!